Robinhood Trading App Fees

No-commission stock trading app Robinhood will let you buy and sell Bitcoin and Ethereum without any added transaction fees starting in February, compared to Coinbase’s 1.5 to 4 percent fees in.

robinhood trading app fees. Invest in stocks, options and ETFs (funds), all commission-free with the Robinhood app. Our trading tools give everyone access to the financial market - whether you're a beginner in investing or a seasoned trading pro. Save, invest in the stock market, and earn money. Here's what you get when you join Robinhood: Finance explained - We’ll help you understand financial markets so you can. NMF: An abbreviation for "no meaningful figure". You'll often see this when comparing financial data among companies where a certain ratio or figure isn't applicable. M1 vs. Robinhood Comparison Review. Which Free Trading App is For Me – Robinhood or M1 Finance? Robo-advisors are popular for a number of reasons, including their ability to save investors money on account management fees, the ease of 24/7 access to portfolios, and simplification—never mind automation—of the investment process.

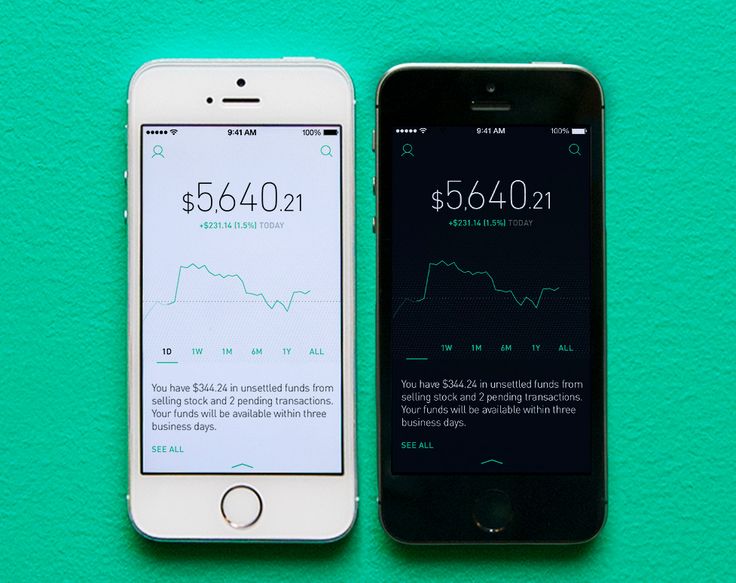

Financial technology start-up Robinhood is gearing up to launch its commission-free stock trading app in the U.K.. The Menlo Park, California-based firm said Wednesday that it was opening a. Robinhood Markets, Inc. is an American financial services company headquartered in Menlo Park, California. The company offers a mobile app and website that offer people the ability to invest in stocks, ETFs, and options through Robinhood Financial and crypto trading through Robinhood Crypto. Robinhood operates a website and mobile apps for iPhone, Apple Watch, and Android. to ask Robinhood Financial if any additional fees will apply. **Most customer accounts are transferred. Commission-free trading refers to $0 commissions for Robinhood. (including ETFs), and options via the app or website. US Listed & OTC Securities (including ETFs), and Options $22.10 per $1,000,000 of principal sells only), rounded up to.

Robinhood is an American-based financial service that offers a trading app to investors looking to trade stocks, crypto, ETFs, and other options. It was founded in 2013 and currently has over 5000+ domestic stocks and 250 global stocks. Not so long ago, Robinhood was highly acclaimed and very popular as it offered free trades. With Robinhood, you can invest in stocks, options, and ETFs, all commission-free. Start with as little as $1. When you join Robinhood: • Learn - We’ll help you understand financial markets so you can confidently invest in stocks, funds and options, all commission-free. • Manage - Before buying a s… However, there are some additional fees on the Robinhood app that we would like to mention for your reference. Robinhood investing app has a regulatory trading fee of $20.70* per $1,000,000 of principal. They calculate this fee to the handiest penny. And again, there is a trading activity fee as per the regulations of the Financial Industry.

Robinhood, a pioneer of commission-free investing, gives you more ways to make your money work harder. Break Free from Commission Fees Make unlimited commission-free trades in stocks, ETFs, and options with Robinhood Financial, as well as buy and sell cryptocurrencies with Robinhood Crypto. Robinhood brokerage hidden fees. Robinhood trading inactivity and annual fee, additional transaction charges. Cost of the broker app investment account. Overview of Hidden Fees at Robinhood If you’re concerned about the pricing schedule at Robinhood and what trading there will cost you, read on. Because Robinhood rounds regulatory transaction fees and trading activity fees to the nearest penny, it may thereby collect more of these fees than it ultimately remits to FINRA. Keep in mind other fees may apply to your brokerage account. Feel free to check out our full fee schedule.

Nothing is free, not even free trading. That point was driven home by "failures" uncovered by regulators at zero-commission trading app Robinhood. Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. Until recently, Robinhood stood out as one. Trading platform reviews are divided when it comes to Robinhood’s mobile app offering, which until 2018 was the only way users could place trades. Firstly, it’s worth noting they offer apps for both iPhone and Android users that can be downloaded from their respective app stores in just a couple of minutes.

Best trading apps: Saxo's app is the best for stock trading, and it has a great search function, a large variety of order types, customizable charts and personalized portfolio overview. Robinhood's mobile app is the best for free stock trading. It is extremely intuitive and well-designed. IG's mobile app is the best for forex trading.